Industrial Property Suited to Heavy Industry in Muncie, Indiana

INDUSTRIAL PROPERTY SUITED to HEAVY INDUSTRY

INDUSTRIAL PROPERTY SUITED to HEAVY INDUSTRY

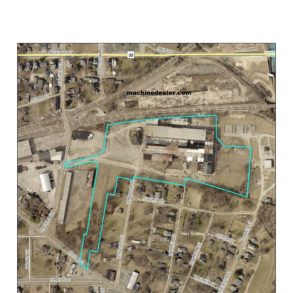

Immediately available, manufacturing and warehouse plant site containing over 120,000 square feet of buildings and 8.5 industrial acres. The original building was completed in 1909 and additions were added throughout the years; Located in the heart of the Hoosier State.

PROPERTY INCLUDES:

Approximately 113,000 sq. ft. Main Building

Approximately 10,000 sq. ft. Office Space

Approximately 13,000 sq. ft. Canopy Area

Bridge Crane in Main Building

Large Air Compressor

8.5 acres of Industrial Property

Large Parking Area

CITY and COUNTY INCENTIVES WHICH MAY BE AVAILABLE:

FREE/DISCOUNTED LAND

The community is willing to consider land grants or discounted land prices as part of an overall incentive package.

TAX INCREMENT FINANCE

New property taxes generated from new construction can be leveraged by the issuance of TIF bonds to incentivize the project.

TAX ABATEMENT

Tax abatements are currently available for both manufacturing equipment (5 or 10 years), for improvements to real estate (3, 6, or 10 years), and information technology and logistical equipment. A recent change in the law allows for a community to offer twenty-year tax abatement on personal property for machinery and equipment.

PERMITTING ASSISTANCE

Knowledgeable staff helps new businesses identify and secure the permits needed for their project. Staff will schedule pre-application meetings between businesses and the appropriate regulatory agencies to help streamline the permitting process. Local permit fees may be waived as a part of an overall incentive package.

EXECUTIVE RELOCATION ASSISTANCE PROGRAM

Moving into a community can be difficult, but moving a number of staff members and making sure they become well-acclimated to the community can be an added challenge. To alleviate this issue, the Economic Development Alliance (EDA) has

developed the Executive Relocation Assistance Program as an important component of our community and company partnership. Services can be customized to the needs of the company or transferring executives, but the program generally includes a community presentation, mentor program, temporary housing, access to professional service, school orientation, residential housing incentive, and access to health care.

TEMPORARY OFFICE SPACE

Temporary office space may be made available at no charge in the Muncie Innovation Connector, the community’s modern, high-tech business incubator.

JOB FAIRS

The Alliance will host customized job fairs in partnership with the local workforce development office to help meet the hiring needs of a company. Fairs include pre-screening stations, interview booths, and computer workstations.

EDIT GRANTS

Funds may be made available through revenue generated from the City and County’s Economic Development Income Tax. These funds are committed at the discretion of the Mayor and Board of County Commissioners.

JOB TRAINING ASSISTANCE

We know that the quality of the workforce is the foundation of any company’s success, and our community has the resources necessary to help make sure those needs are met. Delaware County is home to Ball State University and Ivy Tech Community College. Both institutions have a long history of providing assistance to companies and both will seek to provide custom programs that meet the company’s specific needs.

MUNCIE INDUSTRIAL REVOLVING LOAN PROGRAM

The purpose of the Muncie Industrial Revolving Loan Fund (MIRLF) is to provide incentive for commercial and industrial development which will create permanent private sector jobs for the City of Muncie, Indiana. The program is designed to fill gaps in existing local financial markets and provide or attract capital which would not otherwise be available for economic development. Funds must be used for manufacturing projects, wholesaling trade projects, or limited commercial trade projects.

INDIANA MICHIGAN POWER ECONOMIC DEVELOPMENT RIDER (EDR)

The EDR incentive for a qualified company is a discount on the monthly demand charge for up to 36 months. The discount percentage is 30% for Standard New Development, 35% for Urban Redevelopment and 40% for Brownfield Redevelopment. There are minimum requirements to qualify for I&M’s Economic Development Rider:

- The client must increase load by a minimum of 1,000 kilovolt-amps.

- The client must add at least 10 new FTEs at its I&M territory

- The project must be in direct competition with an area outside of the I&M service territory, thereby making the EDR a decision-making factor in the site location

- The project must fall under one of the approved Standard Industrial Classification (SIC)

STATE of INDIANA INCENTIVES WHICH MAY BE AVAILABLE:

Economic Development for a Growing Economy (EDGE) – Payroll Tax Credit

The Economic Development for a Growing Economy (EDGE) Tax Credit provides an incentive to businesses to support jobs creation, capital investment and to improve the standard of living for Indiana residents. The refundable corporate income tax credit is calculated as a percentage (not to exceed 100%) of the expected increased tax withholdings generated from new jobs creation. The credit certification is phased in annually for up to 10 years based upon the employment ramp-up outlined by the business.

Hoosier Business Investment Tax Credit (HBI)

The Hoosier Business Investment (HBI) Tax Credit provides incentive to businesses to support jobs creation, capital investment and to improve the standard of living for Indiana residents. The non- refundable corporate income tax credits are calculated as a percentage of the eligible capital investment to support the project. The credit may be certified annually, based on the phase-in of eligible capital investment, over a period of two full calendar years from the commencement of the project.

Skills Enhancement Fund (SEF)

The Skills Enhancement Fund (SEF) provides assistance to businesses to support training and upgrading skills of employees required to support new capital investment. The grant may be provided to reimburse a portion (typically 50%) of eligible training costs over a period of two full calendar years from the commencement of the project.

Industrial Development Grant Fund (IDGF)

The Industrial Development Grant Fund (IDGF) provides assistance to municipalities and other eligible entities with off-site infrastructure improvements needed to serve the proposed project site. Upon review and approval of the local recipient’s application, project specific milestones are established for completing the improvements. IDGF will reimburse a portion of the actual total cost of the infrastructure improvements. The assistance will be paid as each milestone is achieved, with final payment upon completion of the last milestone of the infrastructure project.

Headquarters Relocation Tax Credit (HQRTC)

The Headquarters Relocation Tax Credit (HRTC) provides a tax credit to a business that relocates their headquarters to Indiana. The credit is assessed against the corporation’s state tax liability. The credit is up to 50 percent of a corporation’s approved costs of relocating its headquarters to Indiana, as determined by the IEDC. A nine year carry forward applies to any unused part of the credit.

Industrial Recovery Tax Credit (DINO)

The Industrial Recovery (DINO) Tax Credit provides an incentive for investment in former industrial facilities requiring significant rehabilitation or remodeling expenses. The credit is available to owners, developers, and certain lessees of buildings located in an industrial recovery site and placed in service at least 15 years ago. The buildings must have at least 100,000 interior square feet of space that is at least 75% vacant at the time that the application is made. Applications must demonstrate that the industrial facility would not be re-used without the credit.

Research and Development

The state of Indiana offers two tax incentives encouraging investments in research and development. Taxpayers may receive a credit against their Indiana state income tax liability calculated as a percentage of qualified research expenses. In addition, taxpayers may be refunded sales tax paid on purchases of qualified research and development equipment. The Indiana Department of Revenue oversees these incentive programs.

Venture Capital Investment Tax Credit

The Venture Capital Investment Tax Credit program improves access to capital for fast growing Indiana companies by providing individual and corporate investors an additional incentive to invest in early stage firms. Investors who provide qualified debt or equity capital to Indiana companies receive a credit against their Indiana tax liability.

LOCATION: 411 South Windsor St

Muncie, IN 47302

CONTACT SELLER FOR PRICING:

JERRY MAULDIN

MAULDIN MACHINE INC

3024 DISCOVERY DRIVE

JACKSONVILLE, AR 72076

REMIT TO: P.O. BOX 8549

JACKSONVILLE, AR 72078

PHONE: 501-835-5494

EMAIL: mail@mauldinmachine.com

Stk#3005CE